Zakat- How to maximise your giving

Issue 2 Nov / Dec 2003

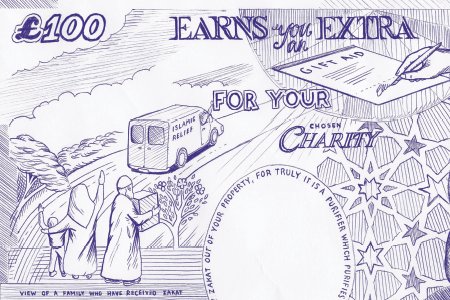

The Prophet Muhammed said: ‘Pay zakat out of your property, for truly it is a purifier which purifies you, and be kind to your relatives, and acknowledge the rights of the poor, neighbours, and beggars’.

Zakat is not literally defined as charity, or even as a tax. Rather, it follows the concept of ‘paying your dues’ – that is, Muslims upholding their duty towards others less fortunate.

Zakat is payable at 2.5% of the wealth one possesses above the nisab. This is the minimum amount of wealth one must own before being liable to pay zakat. This is equal to 87.48g (3oz) of gold, about £650.

Zakat is payable on gold, silver, cash, savings, investments, rental income, business merchandise & profits, shares, securities and bonds.

Zakat is not paid on wealth used for debt repayment or living expenses e.g. clothing, food, housing, transport, education, etc.

There are various ways in which an individual can pay zakat, however few people are aware that it is possible to maximise gift aid and therefore increase the amount of money your chosen charity receives.

According to Aflak Suleman, UK Direct Marketing Manager for Islamic Relief, “Whatever money is donated to charity, this is exempt from income tax and in addition the government have provided incentives for both individuals and businesses to give to charity. For example, under the Gift Aid scheme, if you give £100 for zakat, as a registered charity Islamic Relief is eligible to claim a further £28 from the Inland Revenue. As long as the donor is a tax-payer and has signed a gift aid declaration form, it is possible to claim money back on all current and future gifts.”

In the UK, the tax man will contribute 28p for every £1 of any charitable donation made to a recognised charity. On top of this, individuals paying 40% tax can reduce their income tax by making charitable donations through Gift Aid or Deed of Covenant.

Aidan Close, spokesperson for the Inland Revenue is extremely supportive of this initiative and highlights the fact that there is a wealth of information for anyone wishing to find out more. “We at the Inland Revenue would encourage anyone who is thinking of making a gift to charity to read our information leaflets on Gift Aid and to contact their local Enquiry Centre for further help or information. Gift Aid will increase the value of the gift that is made to the charity.”

Bookmark this |

|

Add to DIGG |

|

Add to del.icio.us |

|

Stumble this |

|

Share on Facebook |

|

Share this |

|

Send to a Friend |

|

Link to this |

|

Printer Friendly |

|

Print in plain text |

|

Comments

0 Comments